Will a hail damage claim affect my insurance premiums in 2016?

what happens to my premium?

Technically speaking and traditional experience would facilitate that the usual answer is “no”. But traditional experience and technical legal language aren’t always accurate. I’ll explain more in a moment and it may not be the answer that you’re expecting. Let’s begin with traditional experience.Most insurance companies do not raise premiums or deductibles for “individuals” for filing a claim due to hail or wind damage. It is considered an Act of God or Nature. It is not the same as an auto accident. If you think about it, it’s not like you can pick up your house and move it to avoid being hit by hail or hurricane force winds. There is a reason why we pay for those insurance premiums year after year- to have coverage when we need it.

There are some insurance companies that offer special discounts for not filing claims over a certain period of time. In the state of Colorado, it is conceivable that it could affect that discount with one insurance company in particular, but that is normally applied to frivolous or multiple claims that are not acts of nature. Overall, the following information will help you decide if filing and insurance claim on your roof for hail damage is right for you. One of the items that I’d like to quickly mention that is if you have actual legitimate hail damage other areas on your property may need to be repaired or replaced.

Haag Engineering Manual

Guttering that is made of aluminum is susceptible to hail impacts and are often times replaced after a hailstorm with large hail stones. Currently most insurance companies replace gutters that have cosmetic damage, however I hear rumblings from the insurance restoration industry of soon coming changes in regards to cosmetic damage. Window screens are consistently damaged from hail stones that are on the windward side of the storm. You wouldn’t expect to see damage to window screens on the leeward side of a thunderstorm. The exterior paint job in a large hail storm may have been impacted. The stones will actually crack the paint and bruise the siding or wood on the property. Outdoor furniture and playground equipment can be negatively impacted from large hail and if the insurance policy language has coverage for this it may be beneficial to file a claim when you begin to see all of the areas that may have been damaged from the hail. Some of these items can be safely inspected from the ground.If you begin to see a lot of damage at ground level there’s a reasonable argument for roof damage. I’d recommend that the roof be inspected before filing a claim.

Can rates increase for a geographical area?

To file or not to file?

While they do not directly increase your premium or deductible individually for filing a claim, if there has been a catastrophic event or series of events in your area in which many claims are filed, historically insurance companies have been known to raise deductibles over the entire area upon renewals to recoup their losses. Generally speaking premiums increase in a geographical area after large hail events even if you don’t file a claim. Friend from another state saw this after Hurricane Ike and they witnessed some policy premiums increasing up to 20% with a spike in the insurance deductibles as well. In Colorado, the deductibles are currently more affordable, but could conceivably increase upon renewals if we continue to have large hail storms affecting widespread areas. Insurance companies do need to keep a healthy bottom line to be strong and viable companies, and this is one way they can protect their bottom line without penalizing clients in low risk areas.

What should I do as a homeowner?

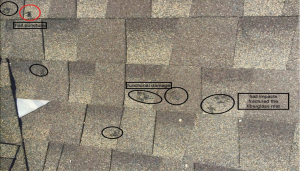

Functional Hail Damage to shingle

What does this mean to me as a homeowner? Well, if you are the owner of a home in an area that was hit by hail or strong damaging winds and you see quite a few neighbors getting roofs replaced, chances are you need to have yours inspected. If it is found to be damaged, Let me describe damage as it should be described by a certified Haag engineering inspector. Damage if cosmetic really doesn’t impact the functionality of the roof system. This is absolutely correct, therefore what an inspector should be looking for is functional damage. The roof system is designed to shed water to the eave of the roof where it is deposited into a gutter or falls to the ground. Functional damage is when the roofs water shedding capabilities are diminished to where the roof system is no longer able to completely do what it was designed to do. Additionally, if a roof system experiences a significant loss of life expectancy then the systems primary function has been compromised and therefore damage. If a roof truly has functional damage it would not only be appropriate but advantageous to file a claim with your insurance carrier. The only issue a home owner may have is knowing whether or not the roof is actually damaged. I will post a video and some photos that may provide enough information to know if your roof really has hail damage. Certainly, if the shingles are not damaged from the hailstorm I’d advise against filing the claim. A roofer that is certified by Haag engineer is a good place to start for your initial inspection. If you have damage and a claim is filed the vast majority of insurance companies will not punish you for doing so. The chances are that your deductible or premium could go up anyway because of your proximity to the location of the storm whether or not you file a claim.

There is a window of opportunity in which to act, so if you are in an area hit by a recent hail storm, it is a good idea to call for a free inspection as soon as possible. If you need a roof surveyed in our area; a licensed roofing Colorado Springs contractor, Integrity Roofing and Painting has certified Haag Engineering roof inspectors that will inspect your property. At Integrity Roofing and Painting, we make roof replacements easy!

Hail Damage Inspection

This blog post was updated on June 25, 2016